Day Trading Investments are gaining a lot of popularity among new investors in the Cryptocurrency Market, but is it worth "investing" in this market?

DePin: Understanding Everything about this Innovative Sector of the Crypto Market!

DePin is one of the areas that is being explored the most in 2025. This sector had a Hype with the Helium project in 2021 and since then, several other crypto projects have followed the same path.

What are DePin projects?

DePIN, short for Decentralized Physical Infrastructure Networks, refers to blockchain-based projects that manage and incentivize real-world physical infrastructure, such as power grids or wireless networks, through decentralized systems. It's like crypto meets the real world, combining blockchain technology with tangible assets!

DePIN projects use blockchain to create decentralized networks where users can contribute resources, such as computing power or hardware, and earn tokens in return. Think of it as a way to crowdsource and manage infrastructure — like Helium for wireless networks or Filecoin for storage — while making it more efficient and community-driven. It's a fascinating mix of crypto innovation and real-world utility!

Related:

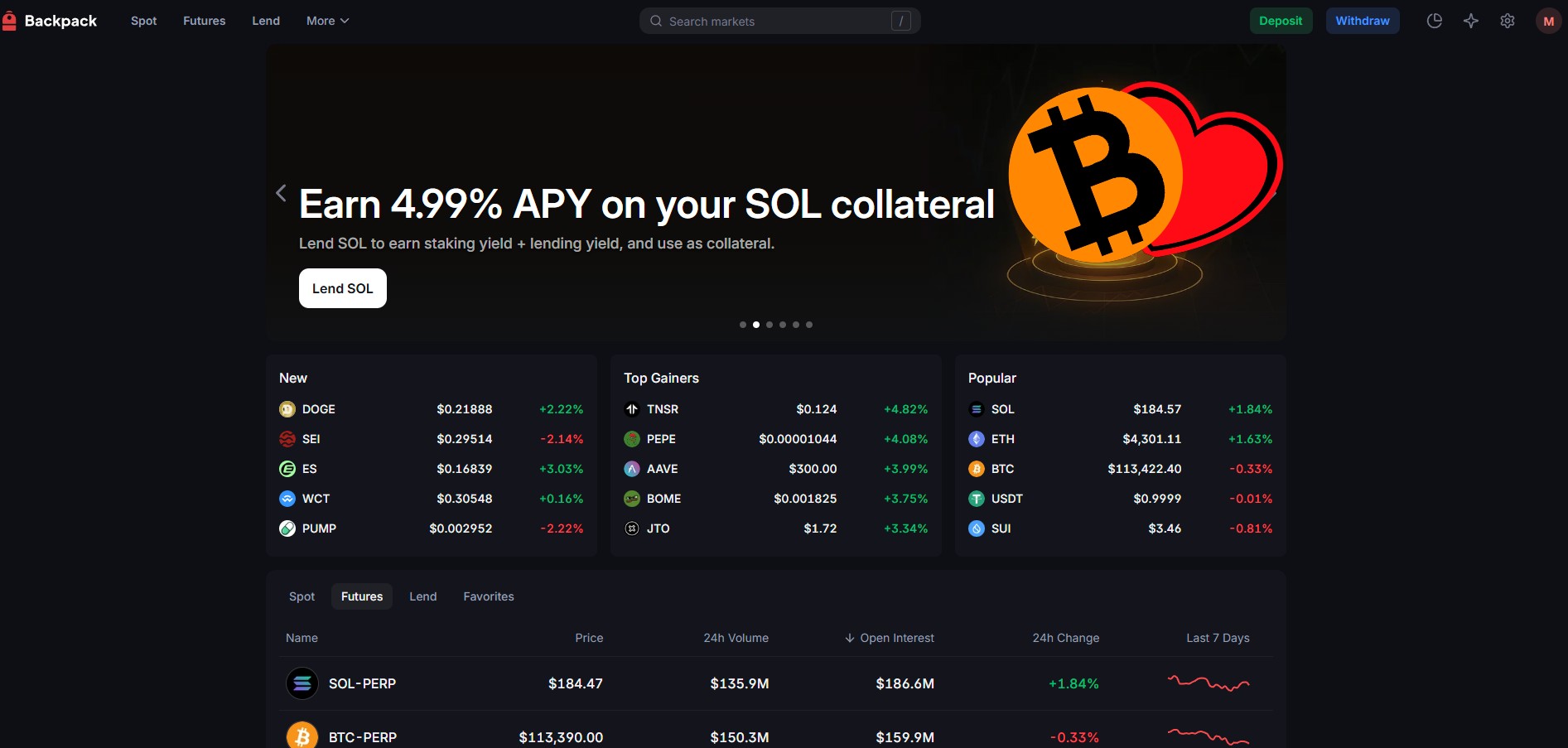

What's the best cryptocurrency exchange on the market today? Some users would put Binance or Bybit at the top of the list, but here comes an exchange that's gaining a lot of traction: Backpack!

DePin is one of the areas that is being explored the most in 2025. This sector had a Hype with the Helium project in 2021 and since then, several other crypto projects have followed the same path.

In this article, you will learn about some tips on Financial Education that, in our opinion, are essential for anyone wishing to Invest in the Cryptocurrency Market. Beginners, youth, seniors and entrepreneurs.

Projects aimed at the DePin sector:

Helium (HNT): A decentralized wireless network where users deploy hotspots to provide IoT connectivity and earn HNT tokens in return.

Filecoin (FIL): A decentralized storage network where users rent out their unused hard disk space to store data and earn FIL tokens.

Render Network (RNDR): A decentralized GPU rendering platform where users contribute computing power to 3D rendering tasks and earn RNDR tokens.

Grass (Grass): A project where users can earn tokens by sharing their unused internet bandwidth. It's a great example of DePIN in action, as it decentralizes and incentivizes the use of physical infrastructure (your internet connection) through blockchain rewards.

How does DePin usage by bandwidth work?

In bandwidth DePIN projects like Nodepay's Crypto Grass, users share their unused internet bandwidth to perform tasks like data routing, VPN services, or content delivery networks. In return, they earn cryptocurrency rewards, creating a decentralized and efficient way to utilize global internet resources — like turning your Wi-Fi into a money-making machine!

Both Grass and NodePay involve earning cryptocurrency through sharing internet bandwidth, but they differ in focus and approach. Grass is an intuitive platform where individuals share their unused bandwidth to support decentralized networks, earning rewards in a simple and accessible way.

NodePay is more technical, often requiring users to set up and manage nodes (servers) to contribute bandwidth, which appeals to those with more advanced technological skills. Both are part of the DePIN ecosystem, but they cater to different audiences — Grass for casual users, NodePay for tech enthusiasts!

Lucas Lippe

The idea of freedom is fascinating and Bitcoin gives us that in many ways. Explaining ideas of a decentralized web on the Bitcoin Lovers website

Also check:

Be the first to read what's new!

Disclaimer:

Cryptocurrency investments are risky. The Bitcoin Lovers website is not responsible for the quality of the products or services presented on the pages and cannot be held responsible, directly or indirectly, for any damage or injury caused after the use of a good or service highlighted in this or any other article. Cryptocurrency related investments are risky in nature, readers should do their own research before taking any action and invest only within the limits of their financial capabilities. This page or any other article does not constitute investment advice.

AMF Recommendations: There is no guaranteed high return, a product with high return potential involves high risk. This risk-taking must be in line with your project, your investment horizon and your ability to lose part of that savings. Do not invest if you are not willing to lose all or part of your capital.